6 Warning Signs You're About to Enter a Bad Trade

Learn how to act on these signs and take better trading decisions

What sets apart professional traders from amateurs?

Is not that they don’t do any mistakes in the market.

Pro traders make mistakes and have the same triggers as amateurs! They’re just able to recognize the early signs that lead them to the big mistake and interrupt the pattern earlier than the amateur, who only realizes he screwed up when it’s too late.

In this article, I outline 6 warning signs you’re about to make a bad trading decision.

After this read, you’ll know how to act toward these signs like a professional trader.

Let’s get right into it.

#1 Overthinking

The most common sign you’re about to make a bad decision is when you start to rationalize it.

Why do humans overthink?

It’s nothing more than a defense mechanism of the brain. It comes from fear of the uncertain. Your brain is working hard to find the certainty it seeks to predict the future and deliver you a reliable answer about what to do.

Except that in the market, there’s no way your brain can find certainty as to what will happen next. So this feature of your brain is actually sabotaging your trading behavior and results.

Your best chance is to switch the object of certainty from the market to your behavior with your strategy.

If your trading plan is simple and objective, then, there should be no doubt about any trading decision. No doubt leads to no surprises and no surprises lead to acceptance of any outcome because there are no expectations attached!

Traders who try to control the market are like teammates who want to control the group project. They micro-manage the way other team members do the work because they don’t trust them.

Quite the same with traders who want to control the market except that it will always be fruitless.

When you learn to work together with the market as a team, you learn the essence of trading: you do your part of the work - playing your system - and you accept the market’s part - giving you the result. You gotta trust the market to do its job!

As long as you do your part in the Long Term, the market will offer you the results of your edge. But you gotta give it space.

Overthinking is about not providing this space. It’s like trying to control the weather.

Action Plan:

Write a simple strategy checklist and look at it before taking any trading decision. If you’re still overthinking using the checklist, is probably because your strategy isn’t well-defined enough. Find the gap and define rules.

#2 Urge To Act

When you feel the urge to act in the market it’s most of the time an urge to fulfill your emotional and certainty needs.

An urge to enter a trade too early means you want to end up with the sense of “I’m not being productive” or you seek excitement;

An urge to trail your stop while the trade is running means you want to cease the discomfort of the risk;

An urge to lock in profits too early means removing the fear of missing out or the fear of loss.

The key?

Becoming aware of the body sensations this urge gives you: the discomfort, the racing heart, the fast shallow breathing.

Where is this urge/fear coming from?

Action Plan:

Control your body’s response to the urge by giving 5 deep diaphragm breaths - the most efficient way to breathe. Breathe in slowly through your nose while your stomach expands and then pass that air to the lungs while your chest expands. Breathe out very slowly with your lips semi-open. Repeat.

Think about the consequences of that urge/fear coming through. Is it really that bad? Won’t you be safe if you miss a trade? Or if you don’t take profits and the market reverses? Your fear is characterized by tunnel vision. Zoom out. It’s just one trade.

#3 Marrying a Trading Idea

At some point in your trading, you already experienced becoming too attached to one view.

The science behind it?

You obsess with a trading idea out of fear of being wrong; fear that one of your beliefs gets corrupted.

For instance, after 3 losses in a row, a trader starts to obsess about a trading idea and might say things like: “I’m not giving up on this idea, I know it’s right, sooner or later the market will reverse”.

The trader only gives up on the idea when the pain of the money lost gets bigger than the ego. Until then, his/her ego will do everything to validate his view.

So whenever you sense that you’re starting to get too attached to a trading idea remember that is only a defense mechanism that’s being activated because your fear is growing.

Action step:

Argue against your view. List the things that may invalidate your trading idea. By thinking about the opposite scenario - the one you’re not married to - you’re more prone to accept it.

Think about a debate contest. The participants are often asked to choose an opinion/view to defend. And then, they’re asked to fight against it. In the beginning, the participant is too attached to the old opinion but by thinking about the opposite scenario he slowly detaches from it and is capable to formulate an opposite view. Do the same in trading! Never get attached to one scenario, develop opinions for all possible reactions.

#4 Careless Mode

When you get so frustrated about losing that you become careless and start to gamble the markets.

Traders are likely to enter this stage when they lost so much money that they were forced to change their view, not about a trading idea, but the view of themselves as traders. They deeply lost confidence in their ability.

The problem is that when you enter this cycle your confidence will keep on spiraling down and the more difficult it is to recover it.

The next day, you regret what you did and you want to correct the behavior but the pain of the mistake and money lost is so big that you’re likely to end up in the same situation.

Action Step:

The key is in interrupting the pattern before it’s too late. Protect yourself from arriving at this stage by being aware of the early signs that lead to the worst-case scenario.

#5 Overconfidence

Overconfidence blinds your perception of risk.

It comes in many ways and it can also lead you to marry a trading idea.

Self-talk like: “Stick to your view, it has been giving you money”; “I guarantee the market’s gonna go this way”; “I’m never wrong, the market is”; “ I knew that would happen”, are pure signs of your overconfidence.

Action Step:

Become aware of this self-talk before it translates into action. Practice your awareness by placing random alarms during your trading session. When the alarm rings, notice your thoughts, emotions, and self-talk.

#6 Unclear Market

Sometimes, your setup is clear and you have no doubt about entering the trade. Other times, your setup isn’t clear but you take the trade anyways because you need to be in.

When you trade in an unclear market you’re not only putting your money at risk but your confidence as a trader too.

The market is never the same. Traders have difficulties acknowledging they can’t control anything about it and even when isn’t favorable to trade, they’ve already decided they will take a trade that day.

If these traders could only be open to the possibility of taking no trade, they would save themselves from a lot of mistakes. But the idea of “wasting time” without being active is unacceptable to them.

A deep lack of confidence mixed with immature impatience is at the root of this behavior.

When you trade in an unclear market you’re not only putting your money at risk but your confidence as a trader too. Think about this.

Action Step:

Gather information on the characteristics that make your setup high quality. Study your winning trades as much as you study your losers.

A Solution!

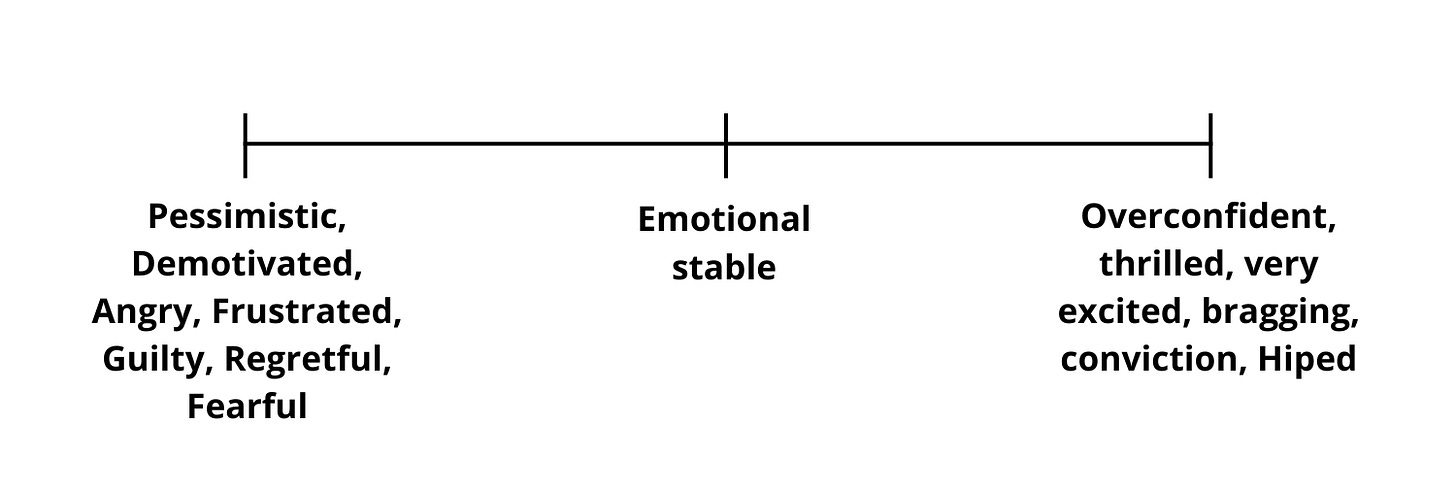

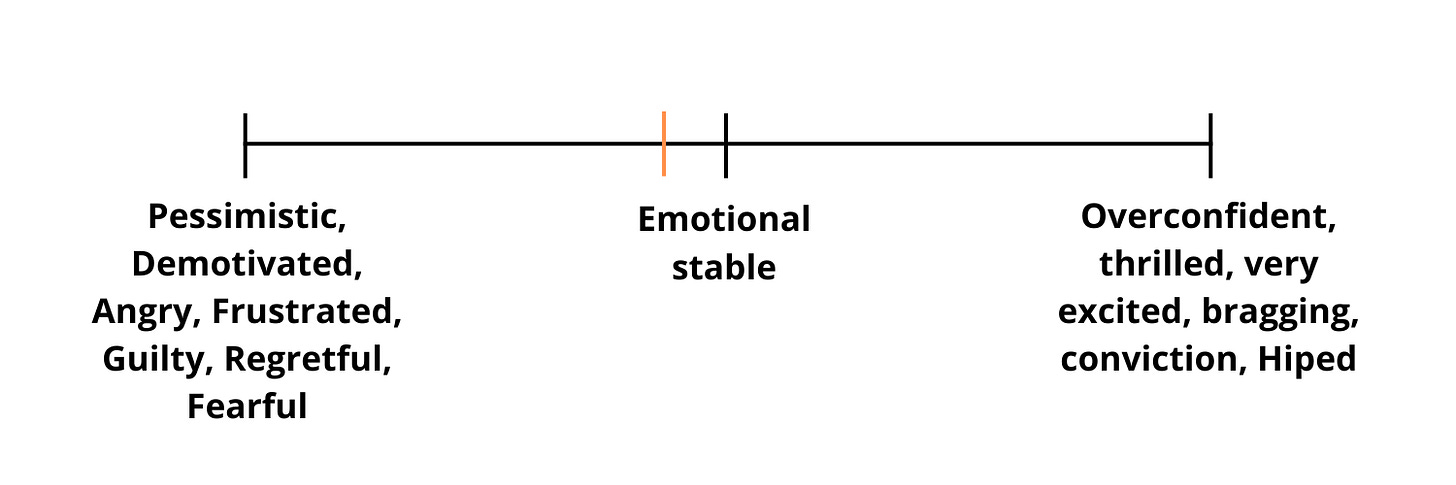

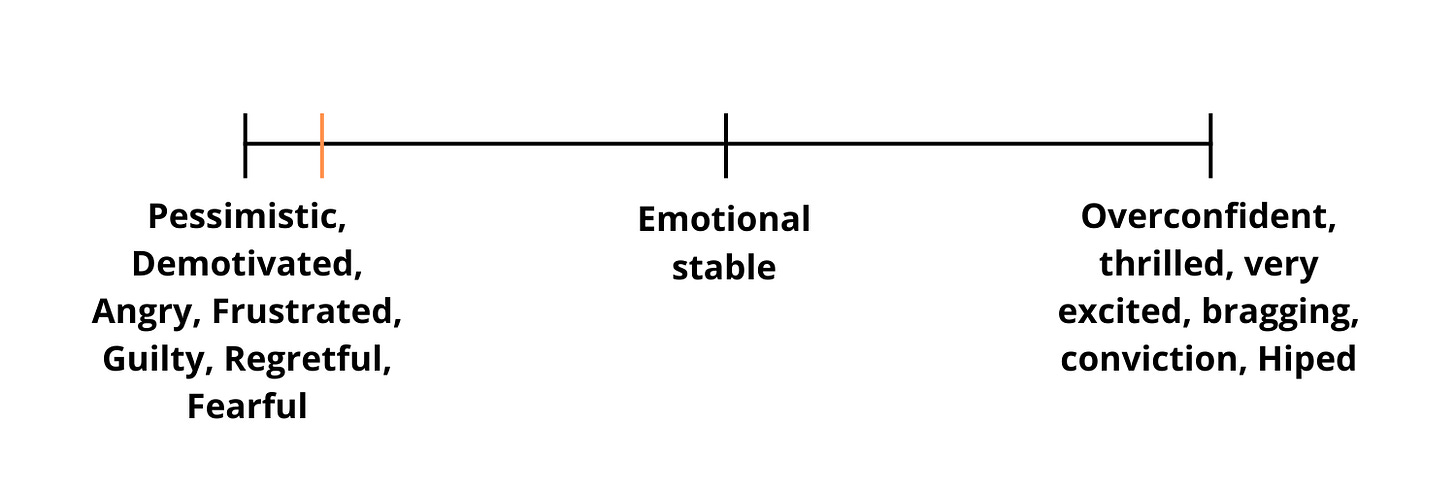

These 6 warning signs make you oscillate in the scale below.

When you overthink, you’re likely to tend to the left side - Fear, and negative thoughts.

When you feel the urge to enter a trade with a bigger size, you’re tending to the right side.

Besides all the small action steps I outlined for each one of these 6 warnings, use this scale to help you take the right decision.

Before entering any trade, answer 3 questions:

What am I feeling?

Where am I on the scale?

Am I ready to go for the next trade?

It might be difficult to give a precise answer to the 2nd question. A great indicator of your readiness to go for the next trade is to execute the diaphragmatic breathing technique I referred to earlier in this article.

Can I relax my body and slow my breathing within 5 min?

If yes, you’re ready. If not, give yourself more time with the breathing technique and know that there’s nothing wrong with giving your day as done.

The goal is to be able to spot yourself in an early stage: when your ability to come back to emotional stability is still possible.

When your emotions are running too high, the best to do is to stay away from the charts and call it a day.

Summary:

6 Alerts that you’re about to make a bad decision in trading:

Overthinking;

Urge to act;

Marrying a trading idea;

Careless mode;

Overconfidence;

Unclear market.

Use the scale before entering any trade and your chances of making the right decision will increase exponentially.

With love,

Sara

P.S. If you have your strategy in the market but you’re struggling with performance - overtrading, oversizing, adding to losers, revenge trading, or hesitation to enter trades - I can help you.

I’ve been helping traders strengthen their mental edge and fix their worst habits to perform at their best: making more money and trading stress-free. If you’re interested in knowing more, fill out the qualification form and we’ll enter in contact with shortly.

Here’s a testimonial from Rob, one of my clients that’s currently trading multiple funding accounts.

Whenever you’re ready, there are 3 ways I can help you:

1- Learn to use emotions in trading with my E-Book here

2- Learn my intraday trading system here

3- Elevate your trading performance with 1:1 coaching here.

Helpful practicals! That scale is a great idea. I see a common theme of 3 c’s: calmness of body, clarity of mind, and commitment to edge