A Hidden Risk You Aren't Thinking Enough About

What's the risk of NOT doing something?

Visit all unlocked posts here.

Before I start, I want to thank Sara for giving me the opportunity to write a guest post for her readers.

I’ve really enjoyed engaging with Sara via Substack by reading and commenting on her notes and posts.

She is smart and genuine. You can tell she wants to help, and we need more people like her in this industry.

Thank you Sara, and I look forward to more collabs in the future with you if this one goes well!

How do you think about risk?

I bet you I think about risk completely differently than you do. What seems "risky" can be very subjective.

I've been an active participant and student of markets every single day since 2013. Not 1 hour a day, more like 12 hours a day.

Over the years, I've slowly transitioned from asking myself, "What is the risk of doing this?" to, "What is the risk of NOT doing this?"

In 2014 I was working as an accountant in the accounts receivable department for an engineer consulting company specializing in transportation.

Whatever the heck that means.

I had almost $15,000 in a retirement account with them, and I was able to transfer it over to an IRA with TastyTrade and start trading defined-risk option spreads in a live trading account.

I had a margin account as well, which I "day-traded" with, and I took full advantage of fooling around with ideas in a paper trade account alongside those, too.

It wasn't long before that $15,000 account was depleted to almost $5,000. It was time to regroup at that point.

Was I too risky?

At the moment, it certainly felt like that.

At that moment, I was watching the S&P skyrocket higher while my retirement account was down -66% in the year. It's easy to feel like a fool and like I took too much risk.

The 22-year-old kid learned a good lesson the hard way. Trading ain't easy, kid.

What if I never took that risk, though?

I wonder how different my life would be today if that deterred me from ever participating in markets again. I could have quit, called up a financial advisor, and sold my financial soul to him on the spot after an experience like that.

Whatever the heck I was doing in my margin account at the time wasn't breeding much confidence either.

I was one of those "break-even traders." You know, the guy who says he's been trading for a year or two and he's "just breaking even."

It's so easy to quit right there. But I didn't.

Taking that risk and having that experience created more curiosity, interest, fire, passion, and obsession. It was on.

I was so lucky to have taken that risk, which led me to fall in love with a new passion for understanding and participating in financial markets.

I took more risks around this.

I quit my accounting job a year later for a lower-paying job that allowed me to work from home and focus more on markets. My friends and family thought I was crazy!

It looked risky.

Nine years later, that risk looks to have paid off. Taking the risk put me on a new path, creating a new financial framework.

It helped me find like-minded individuals with a little help from the internet. It led me to Sky View Trading and the career I have with them today, which I am in love with. It sure beats the hell out of auditing per-diem travel expenses in the accounting cubicle.

If I never took that initial risk 11 years ago, or if I quit after I got burned (in the short term) taking that risk, it's scary to think about what my life might look like right now. Forget the money; I don't think I would be as happy with my life and career as I am today.

What's the risk of trying? That's not the right question to ask.

The right question to ask is, what's the risk of NOT trying?

We can find so many examples of this in our lives or financial markets. I often bring up the example of the S&P's and Treasury Bills in 2022-2023.

In 2022, the S&P 500 fell -19%.

Investors were scared of that -19% drop in 2022, so in 2023, we saw a record inflow into money-market savings accounts and Treasury Bills that were yielding +5% annually “risk-free.”

In other words, investors did not want to take the risk that the S&P's would have another bad year, so there was a record inflow of investors choosing a risk-free +5% annual yield coming into 2023.

The S&P's then proceeded to finish 2023 up +24%.

That means all those investors in 2023 who chose the risk-free +5% yield ended up losing -19% on their money compared with staying invested in the S&P's, which returned +24%.

The irony.

It seems they asked the wrong question. They focused on the wrong risk.

Like my friend.

I have a friend who has a great job in traditional finance, who I bring up often.

Lately, he won’t stop feeding me theories about how Bitcoin could collapse. He sends me videos from news organizations who are known to have guests on that chat about "doomsday" and how we need to invest in Gold.

He proudly states that he invests not only in gold but also in gold miners. Unsurprisingly, he doesn't love the idea of selling naked option premium either.

Trading comparisons aside for now, spot Gold has generally outperformed Gold stocks and Gold miners for decades at this point.

GDX is a popular Gold mining ETF that is down -40% since 2010. It's up about +12% since the close of 2020, and that’s only because this year alone it’s up about +33%.

The price of Gold is up about +38% since the close of 2020.

I won’t tell you how much Bitcoin is up since 2010 because it will depress us all knowing we could have a few hundred million dollars extra in our bank account if we bought a batch.

Since the close of 2020 though, Bitcoin is up about +122%.

I'm not trying to cherry-pick data, either. Bitcoin was up over +300% alone in 2020, that is before it went up another +122% from January 2021 to today.

My friend also bought a tiny bit of Bitcoin many years ago. He's been too scared to really buy any more, though.

He keeps focusing on, "What's the risk if I buy more?" He's not focusing much on the other side of that risk.

What's the risk if he doesn't buy more?

What's the risk if he continues to invest in asset classes that have been underperforming?

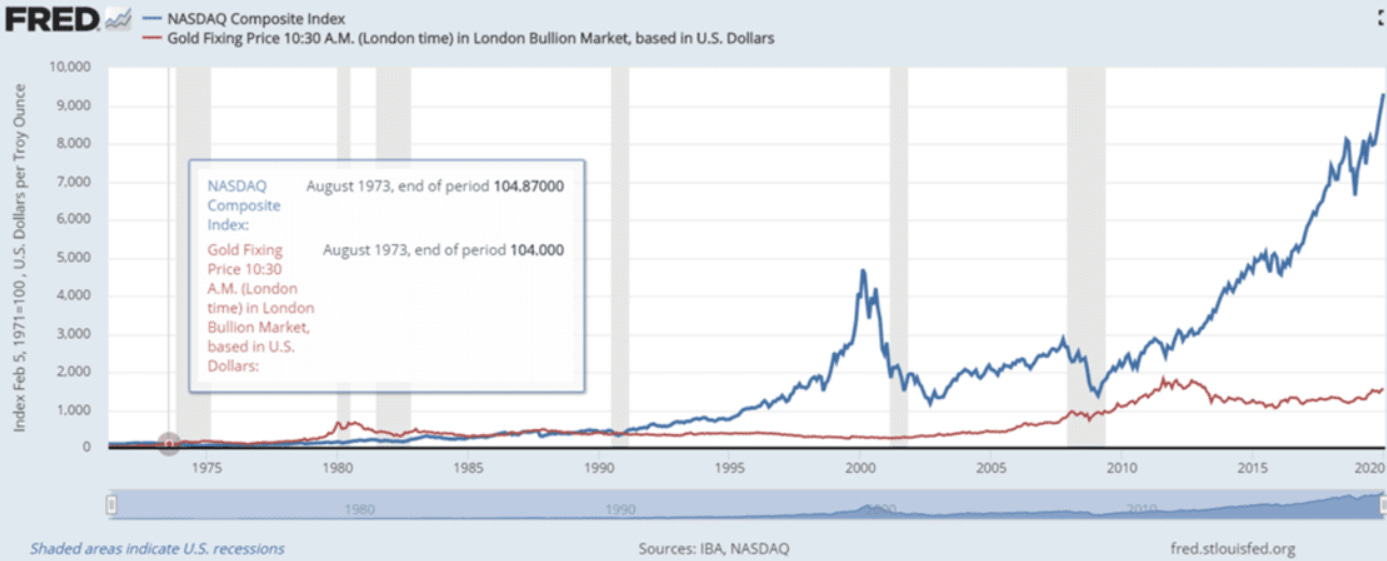

Here is a chart of Gold (red line) vs the Nasdaq (blue line) since the 1970's.

The difference above is 10-fold. Like, the difference between having a $100,000 profit and a $1,000,000 profit.

Below is a chart of gold (green line) vs the S&P's (blue line) since 2010. The string of D's are the dividends SPY gave, I wasn't able to remove those icons.

Keep in mind the start date here is fresh after the housing crisis in 2010, which is the time every Central Bank in the world, with the US at the forefront, started increasing their money supply by more magnitudes than ever before in history.

It also looks like that will be the Central Bank's playbook for the foreseeable future.

Again, almost a 10-fold difference.

Is taking the same risk he just took in the last 1, 4, or 10 years worth it for the next 1, 4, or 10 years?

How much could that potentially cost him over the next 1, 4, or 10 years?

Only time will tell, I guess. That's the fun in all of this, right!?

Different risk profiles.

It's also fair to say we all have different risk profiles as a participant in markets. So, you might be okay with giving up upside returns in exchange for more security.

But when we analyze the data a bit more in-depth, like we did above, it's also only fair to say to yourself, "What a minute, what is the real risk here?"

In other words, what's the difference between missing out on 10X the money versus potentially losing an extra 50% of your investment? Both suck the same. Both are risky.

In fact, missing out on 10X the gains costs you way more money than losing an extra 50%.

The question is, which risk are you more comfortable taking? The question is, which risk is really more dangerous?

In any event, these can be interesting exercises to help keep you up at night if you are interested.

I get to read some of the sales notes from our team over at Sky View Trading, and there are some leads who come to us talking about how they've lost anywhere from $10k to $100k over the last year's trading markets.

Many of those same folks hear that we target 20-40% annual returns with our trading, and they get turned off. It's too little for them.

They are looking for 10-20% per month. They think that's possible, and they don't want to spend money with us even though they trust and believe we have a vibrant trading community of members who are generating the returns we claim.

These folks don't want to spend the money to join our community, but they don't understand how much money the decision to NOT join just cost them in the long run.

In a way, that thought process is similar to the debate of selling option premium vs buying option premium. "Undefined risk” vs. "unlimited profit.”

There are so many horror stories about the "risks" of selling naked premiums. Many of the horror stories seem to come from those with little experience selling premium options, though.

The biggest haters of selling naked premiums seem to be the "traders" who have been "breaking even" over the last year or two.

Don't be that market participant.

As the years progress, I continue to do my best to start thinking about risk from all angles. The risk of doing something is only one part of the equation.

Equally as important to ask ourselves, as objectively as we possibly can, is what the risk of NOT doing something is.

That’s the risk that keeps me up at night.

Sleep tight.

— Guest Post by Christos V (Simply Finance)

I hope you enjoyed reading Simply Finance.

I write a small FREE NEWSLETTER and put out a lot of content. If you enjoy it, the best way to help me out would be to share it with someone else.

And don’t forget to subscribe so you don’t miss the next one over at Simply Finance.

Disclaimer: These are not recommendations and I am not a financial advisor. These are just my two cents, or two satoshis as the kids say. Remember to do your own homework before making any financial decisions. Also, keep in mind I usually have some personal investments in the things I discuss.

Thank you Christos for your input! You got me right at the point when i have to make a decision to either go to my old job or keep pushing!

The S & P could be up 50% in a year but that does not mean your portfolio will see those gains. It depends on the investments you make, the stocks you own and how long you keep them. Investing/trading is never a one-size-fits-all endeavor. Wall Street likes to trick the public with their nonsense and that is one reason why the majority fail.