How Dopamine Shapes Emotional Trading (and How to Break Free)

The Thursday Trader's Tip edition offers to-the-point trading performance advice that can be read under 5 minutes.

Leverage Trading Accountability with the Paid Plan:

If you’ve been trading for a while, you probably know the market can humble you in ways you didn’t think were possible.

That’s exactly what happened to Neto — a client of mine who shared his story of market trauma in this post:

In 2023, after 18 months of consistent SPY trading, Neto decided to level up: new tickers, new strategy, new community.

He was excited.

Within days, everything started falling apart when he made some rash decisions. In one session, he froze while the market kept going against him. He couldn’t click the sell button.

The loss that followed wasn’t just a big financial hit — it was emotional.

Afterward, he started doubting his entries. Hesitating on valid setups. Losing trust in himself.

He became afraid of the market — and of himself in it.

Today’s post is about how a loss can create market trauma, how that trauma is stored chemically in the brain, and how to break free from that chemical loop.

Your Brain Learns from the Gap

Your brain doesn’t just learn from outcomes. It learns from the gap between what it expected and what happened.

This gap is called the prediction error, and it’s how dopamine drives behavior.

Here’s what happens:

When the outcome is better than expected → dopamine spike

When the outcome is worse than expected → dopamine dip

Before the huge loss Neto experienced, he had a big, oversized winner. He mentioned it was the biggest win he ever had in trading. This created a massive prediction error — a bigger reward than expected, triggering a dopamine spike.

And because the brain is wired to repeat what caused dopamine spikes… The next time he lost, that same urge to make it back felt even stronger, which led him to the huge loss mentioned above.

The Double-Edged Sword of Dopamine

In the last webinar we discussed the role of dopamine in trading habits and Lawrence (one of the traders I work with) said something that stuck with me:

“It’s wild that dopamine is what motivates us to trade and also the thing that screws us the most.”

Dopamine is what fuels the desire to grow, to improve, to explore your potential. But it can also be what drives the need to win, the urge to chase…

It’s the same chemical, for the good and for the bad. It depends entirely on the loop you build around it.

The Dopamine Reward Prediction Error

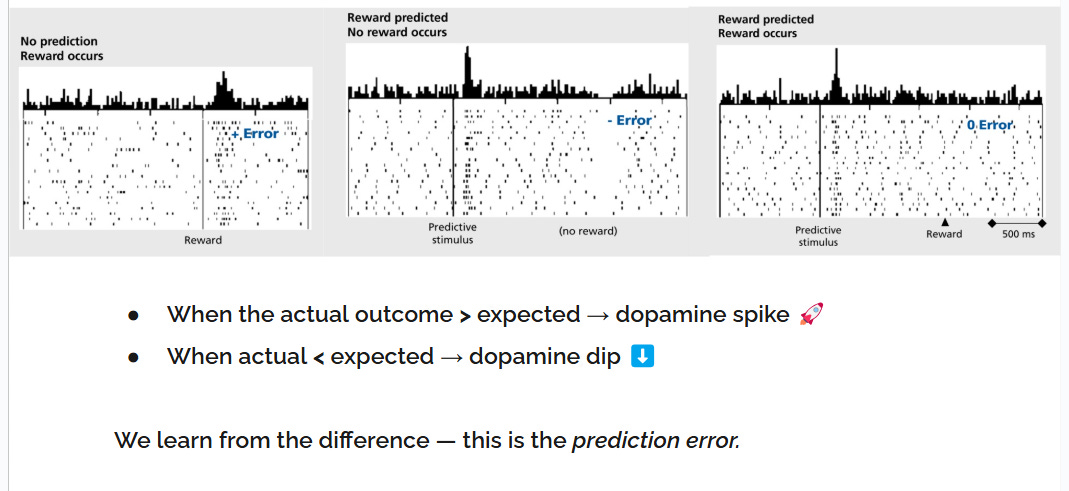

Here’s an image from a study on how our brains process reward prediction errors.

Scenario 1: There is no prediction, then there’s a random reward. Dopamine spikes. We have a positive error between expectation and reality.

Scenario 2: You expect a reward, but don’t get one. Notice how dopamine dips below baseline. There’s a negative error between expectation and reality. This is the most dangerous scenario. This crash leads traders to revenge trade, just to feel normal again.

Scenario 3: You expect a reward, and get it. But because there’s no surprise (prediction error), there’s no dopamine spike. Your brain registers it as neutral.

Scenario 1 is the healthiest.

The best way to achieve a state of no expectations or predictions is to spread them across multiple market scenarios and possible outcomes constantly throughout the session — what I call the “anything can happen at any point in time” mindset. I talk more about how to achieve it here.

How to Fight Back: Control Your Predictions

You can’t control the market.

But you can control your expectations.

And expectations control dopamine.

Which means:

Stop expecting a win after every good setup.

Stop expecting losses to be balanced out by extra effort.

Start focusing on executing your process, not controlling your outcomes.

Every time you disconnect your emotional state from short-term results, you weaken the addiction loop.

You start building a stable dopamine system — one where your emotional highs and lows don’t depend on random rewards.

And that’s how mental resilience is built.

Peaceful trading,

Sara

P.S. In the last webinar I talked about this topic, you can watch it here:

If you enjoyed the post, consider upgrading to the paid plan:

Related Reads:

loved the image about how brains process reward prediction errors.

Absolutely spot on, Sara.

This mirrors what many Indian investors face too the emotional tailspin after a big win or a sudden loss. It’s not bad strategy, it’s untrained psychology. That dopamine loop you mentioned? It’s why long-term success depends more on mental resilience than market predictions.

In equity investing, especially in India’s volatile markets, the real edge is emotional discipline. Process over outcome, always.