Ego-Fear Connection: How To Break Free from Fear While Trading

The True Origin of Fear and How to Defeat It

Scroll to the bottom of this post to listen to the audio version of this newsletter.

In this week’s newsletter, I talk about the real origin of fear and its impact on your market perceptions.

By understanding the science behind fear, you can better manage it in your trading and reshape your perspective of the events that trigger this fear in you.

Why Do We Crave Certainty?

As humans, our brains are wired to seek certainty - a mechanism that’s part of our nature. We are constantly predicting the outcome of every event we experience in life.

For our brains, each situation boils down to two potential outcomes: safety or danger. “Will this make me safe, or does this represent a threat to my survival?”. Our perception determines these outcomes, and our past experiences dictate our perception.

Certainty brings a sense of safety.

When facing a similar situation to one we have experienced in the past, our brain recalls the familiar emotional response and reproduces it. This is a way for the body to achieve one of its fundamental objectives: conserving energy.

Rather than trying to figure out a new response that is energetically costly, the brain reactivates the old circuitry associated with the past experience.

On top of that, our brain knows that the old emotional response led to survival, so it’s the one he will bring to life.

Whether the emotional response is most relevant and adequate for the present context or not has little significance from the perspective of the brain and body. This means we’re living a predictable past most of the time.

Conversely, uncertainty brings danger.

Our survival is questioned. In the face of a threat, our bodies prepare us for the fight or flight mechanism. Without the capacity to predict what will happen next, we are left in the middle of the unknown. We find ourselves in a completely new situation in which our brain doesn't yet have the necessary schemas to process it.

Fear can be very useful to alarm us of potential threats. However, in the trading environment, it traps us more often than protects us.

Finding Comfort Under Uncertainty

How can we feel comfortable in an environment that goes against our nature?

What constitutes a source of fear is highly dependent upon our perception. If we define something as a threat, we will experience it as threatening, and that will trigger a fear response.

The problem is that we don’t consciously choose what we’re afraid of. Our past experiences and brains dictate that for us.

At the same time, there’s this idea that we must remove fear from the game and trade emotionless. This is asking the impossible.

Decision takes emotion that initiates in the body.

You can, and you will feel anxious, fearful, angry, confident, mad, or happy while you trade. And you can still make good decisions with these emotions. As long as they’re not too intense and overwhelming, they’re still manageable. The solution lies in diminishing the power of fear so it no longer dictates your choices.

The Connection Between Fear and Ego

Fear only exists in the presence of ego. While we do require ego for trading, there's no need to take it to an extreme where every market situation feels like a direct assault or approval of our ego.

Your ego is your self-image created by thought. It’s your social mask requiring validation because it lives in fear of losing its sense of identity.

~ Thibaut

Ego isn't who you really are but who you think you are.

The ego’s job is to protect us, so it always looks for danger. Even if there’s no danger, our ego expects something to go wrong.

That is its role: seek out threats so it can protect us from any harm, real or imagined, by the egoic mind. This negative outlook on life is why the natural state of the ego is fear.

The egoic mind thinks for it to survive, it must be in control of our lives. It holds the belief that it’s always right as its only evidence to maintain control over us. Whenever fear surfaces, indicating uncertainty and lack of control, our egos function as defense mechanisms, aiming to keep us regulated and in control.

When you try to satisfy your need for certainty in the markets, you're essentially trying to fit market information into your existing beliefs. Consequently, your trading performance becomes a mirror of your self-image. You take critical market situations personally because you see them as an attack on your identity - that you need to protect.

The ego is the defense of the mind.

Why do we believe? To defend ourselves.

The ego is not just the sense of self-importance and self-esteem but includes all our beliefs about ourselves, both right and wrong.

Let’s take the example of a trader who grew up in an environment that constantly brought him down. Growing up, he fed the belief that he is not good enough - this became part of his ego. He got familiar with this feeling, and it became a habit. His behavior reflects a lack of self-confidence and self-esteem. Although these are unproductive emotions, this trader is used to living with them, so it formed his comfort zone; it’s all he knows! It became his reality! The image of “not being good enough” established his belief about himself, and he will behave according to that.

We actively seek situations that support our existing beliefs - confirmation bias. If our trader believes he's worthless, this bias leads him to seek out life situations that reinforce the belief. For instance, he will search for opportunities where he can feel like a victim. In trading, he will say the market is against him. Losses will be seen as “I’m not good enough,” and this will create an endless loop of bad habits fed by his ego.

The ego does not want an end to its “problems” because they are part of its identity. It gives definition to our self-image, makes us into someone, and that is all that matters to the ego.

~ Eckhart Tolle

So, if you want to remove fear in trading, you need to lower your ego first -the one seeking control over everything.

To accomplish this, two essential steps come into play:

A shift in perception about the object of fear;

Mindfulness - to detach from the interference that keeps us from accessing our full potential - the overthinking, the rationalizing, the negative self-talk, and the narratives that go inside our heads.

A Shift In Perception

In order to change your perception, you need to submit to new experiences with the object you fear - the market, a loss, a missed trade.

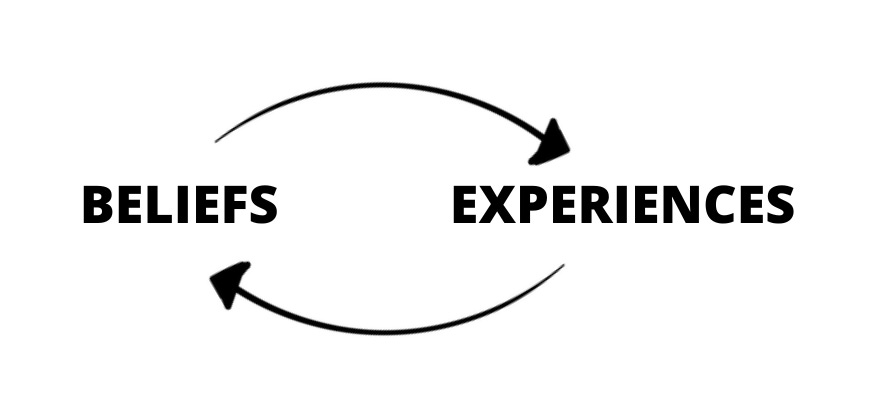

Only by creating new experiences will you allow yourself to build a new repertoire of experiences that will produce a new belief in the brain. And the more you strengthen this new belief, the more ready you will be to search for new experiences on the object you fear. It’s all a cycle.

However, these new experiences can't be approached with the same old perspective that triggers the same old response. That would simply be a replay of the past.

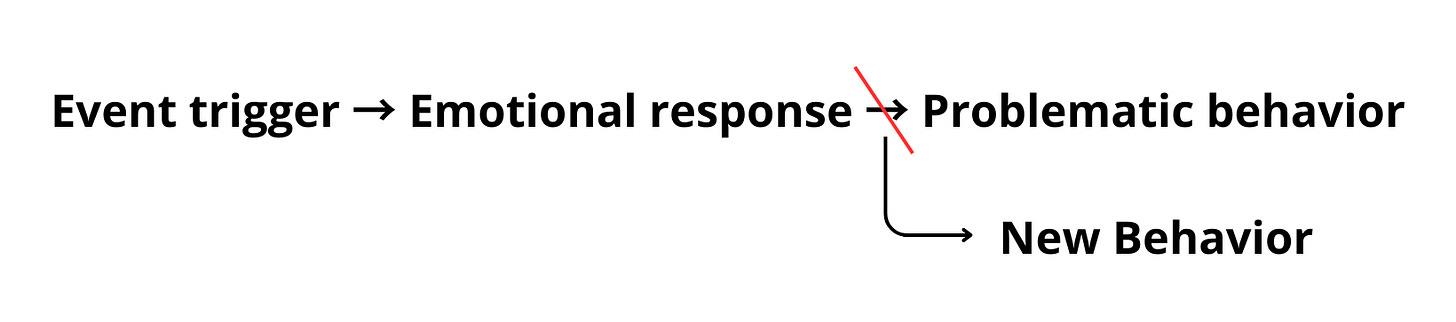

We need to step out from the old cycle and initiate a new different path. In the face of the old situation, we need to be the ones putting a break between the emotional response and the problematic behavior and practice a new response that goes in alignment with the new belief we want to construct.

As soon as you become aware of the emotions leading you to the same behavior, you can choose to disrupt the autopilot mode, and then, create a new pathway.

In the beginning, this won't feel natural; after all, your brain doesn't have the established pathways for the new association you're trying to build. But the biggest amount of effort is required in the beginning. Once the ball is rolling, repetition becomes easier, and the new association gains momentum on its own.

As an example, if one loss triggers emotions of fear, making you want to take an impulsive trade, now, as soon as you realize this fear is arising, instead of incurring the old behavior, you interrupt the pattern by executing a 5-minute breathing technique at your desk or write down the consequences of acting on the fear.

Over time, without responding to the anger stemming from a loss, your brain will begin to perceive it as inadequate and useless. Consequently, it will substitute these emotions with the ones associated with your coping behavior - mental stability, a composed mind, and a sense of control - until you no longer need to execute it to make the belief alive.

There is no secret to changing your bad patterns in the market. If you want to sustain new beliefs, you need to reinforce new behaviors!

With love,

Sara

Audio

If you liked this post/episode, click the like button to support my work. If you loved it, I would appreciate a share:

Whenever you’re ready, there are 3 ways I can help you:

My E-Book: Building The Mindset Of a Trader: Includes practical activities that you can directly apply in your trading and see real-time progress, private community access, and live class invitations.

One-on-One Coaching Program: Various packages are available with different timeframes and prices. These slots are limited to 3 traders simultaneously, as I guide each trader closely to achieve their goals. Fill out the qualification form here.

My Twitter: Read daily nuggets of wisdom and practical steps to improve your trading psychology & performance.

5 min deep breathing I must try kindly provide me the ebook

I will pay by ..

Wonderful essay Sarah.

I read another article on Substack that addressed the concept of "Calibrating to The Risk, Not The Fear."

This simple mantra has changed my life. I use it not only in investing but in my personal life.

Game changer.