Stop Walking the Tightrope: How to Build "Guardrails" for Consistent Trading

The secret to consistent performance.

It’s the first Sunday of the month, which means I’m unlocking a paid post for everyone.

Want to have access to coaching tools, mental frameworks, and live webinars? Upgrade to paid to get the full impact in your trading:

Every trader wants to be disciplined.

You build a plan, set rules, and promise yourself you'll follow them perfectly.

But then a setup you didn't plan for screams, “Take me!” Or a trade goes against you, and you find yourself breaking a rule.

Most of us think that one mistake means we've failed—we beat ourselves up, and that pressure leads to more mistakes.

We end up on a tightrope, desperately trying not to wobble, terrified of falling.

But what if you didn't have to be perfect?

In my work as a performance coach, one thing that separates the highest-performing traders is this:

They don't walk a tightrope—they build guardrails.

That's what this post is all about. We'll explore why ditching perfectionism is the key to consistency.

Today, you'll learn:

How to build guardrails that give you freedom without losing discipline.

The power of the 80% performance accuracy rule

A simple way to track your performance that focuses on the process

An Excel template you can start using next week to track strategy adherence

Let’s dive in!

Guardrails: Your Framework for Flexibility

Strict rules may look like discipline, but they actually choke your performance. This is something I see again and again with my clients.

Guardrails, on the other hand, give you structure without suffocation. They give you the room to move, adapt, and grow.

The difference?

A tightrope demands perfection.

Guardrails allow for imperfection without escalation.

A tightrope mentality says: “I must follow every rule perfectly, or I'm a failure.”

A guardrail says: “I know my ideal path, but I've designed for the inevitable wobble.”

Let's say a trade is moving in your favor, but you get a little nervous and exit before it hits your target.

A tightrope mindset sees this as a failure. You beat yourself up for not trusting your plan. You might even jump into a new trade to make up for the loss, which is a classic escalation.

A guardrail mindset acknowledges the early exit as a small mistake. You think, “I was scared and exited early, but I took a profit, and I followed my risk management rules. My system handled the imperfection.” You review the trade in your journal to understand the emotional trigger, and new awareness is born from there — because you forgave yourself.

Guardrails give you the mental space to think and accept — necessary components to help you move forward.

Let’s discuss how to put this into practice.

The "80% Rule" for Sustainable Performance

Many Olympic coaches live by a similar philosophy: the 80/20 rule.

In a study on Olympic endurance by scientist Stephen Seiler, something unexpected came up:

The most successful athletes spend roughly 80% of their training at a low to medium intensity, reserving only 20% for high-intensity, maximal effort.

This isn't about being lazy; it's about being strategic.

Legendary marathoner Eliud Kipchoge is famous for applying this exact method. When he’s preparing for a marathon, he'll run over 120 miles a week, but most of those miles are at a slow, easy pace—sometimes as much as four minutes per mile slower than his race speed. He does this because he knows that pushing to 100% every single day leads to injury, burnout, and a decline in performance. His high-intensity track workouts, where he truly pushes his limits, are scheduled just twice a week, allowing for full recovery in between.

In trading, the same principle applies.

You don't need to trade every setup perfectly every time; you need to trade well enough consistently.

Chasing 100% adherence to every rule every single day is a recipe for mental exhaustion. And the irony? The more you focus on perfection, the more mistakes you’ll make (trust me, I see this way too often!)

Those who have better self-acceptance achieve the exact results the “perfectionists” longed for. The true secret to long-term success isn't perfection—it's resilience.

The key to success is not in the 80% but in how you handle the other 20%—the mistakes, the losing streaks, the missed entries.

As long as you manage them effectively, you’ll survive and continue to improve. But for that, you need the magic ingredient… self-acceptance.

The best traders aren't perfect; they're masters of recovery.

Track What Truly Matters: Adherence and Recovery

I suggest you start tracking your psychological discipline. This is where you can see the value of guardrails in action.

Tracking Strategy Adherence

For each trade, score yourself based on how many rules you followed.

For example, if you have five rules and follow four of them, your score is 4/5 (80%). By adding a simple rule score column to your trading journal, you can:

Average your adherence over a day or week.

Spot patterns (e.g., your adherence drops after the first loss of the day).

This data gives you a clear, objective measure of your trading psychology.

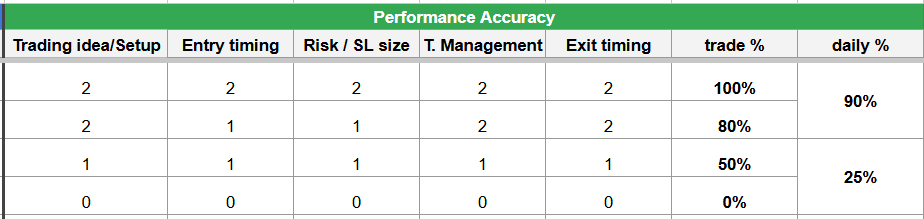

Here’s an Excel example:

For each of the five parameters, I use a 0-2 rating, and to add objectivity, I use the descriptions below:

Note: If you rate the setup as a 0, the other parameters are automatically scored as 0. It's pointless to have a great entry or exit on a trade that shouldn't have been taken in the first place. This helps you reframe success around your process, not the outcome.

Tracking Recovery from Deviations

Not every deviation from your plan has to lead to disaster.

The real goal isn't to be perfect; it's to prevent a small mistake from turning into a downward spiral.

This system helps you track this “escalation” metric, too.

Looking at a series of trades, you can see the quality of each one. For instance, if you took five trades in a day and the last three were off-strategy (they scored 0 on “setup”), you can pinpoint the moment the escalation began—perhaps after that first invalid trade. This gives you a realistic benchmark for improvement.

The more you use this system, the more you'll see that a broken rule isn't a failure. The ability to stop a downward spiral is the true sign of growth.

I've prepared an Excel template for you to use this. Once you open the document, make a copy by clicking "File" and then "Make a copy."

In Closing

You don't need to trade with the pressure to follow your rules 100% of the time, every time. That backfires.

Strive to follow them 80% of the time and manage yourself like a pro in the other 20%. That means allowing for mistakes, but never let them result into huge losses.

Build your guardrails. Create mental space. And let that freedom fuel your best trading performance yet.

Start using the Strategy Adherence Spreadsheet this Monday, and feel free to give me feedback in the comments — I always love to hear it.

And… if you’d like access to more coaching tools, mental frameworks, and live webinars (I always share the recordings here), upgrade to paid to get the full experience:

With love,

Sara

Related Reads:

Wow Sara, you are such a godsend! I just bought the "Mental Game of Trading" book by Jared Tendler and was about to create a basic spreadsheet to track my trades. The spreadsheet you put together is such an amazing tool to track my consistency going forward and better than anything else I've seen online! I'm so excited to start using it from tomorrow.

Also, I'm a perfectionist and I love your bit about not trying to be 100% consistent. The 80-20 rule is so practical and implementable for people with my traits. You just made my day! Thank you again Sara for your amazing writing and practical tools!

Hey Sara - perhaps you’ve explored this before but in having finished Rich Diviney’s book, “The Attributes” … the author (retired Navy SEALS officer) highlights an oft overlooked distinction between self-discipline and external discipline: they’re not the same, and can often diverge, and he provides strong evidence to support this. Meaning, having strength in one often doesn’t translate to the other and vice versa. Their training and ethos is quite applicable because it’s all about achieving optimal (not peak) performance in high-stakes uncertainty - sounds familiar. Would be great to hear your thoughts on this distinction or point us to an already penned note?