The Path to Becoming an Exceptional Loser

Sharpening Your Skills to Overcome Trading Losses Effortlessly

A small gift: If you’re a free subscriber eager to try the paid plan, you can redeem your single-use unlock on this post.

Find the audio version of this post at the bottom.

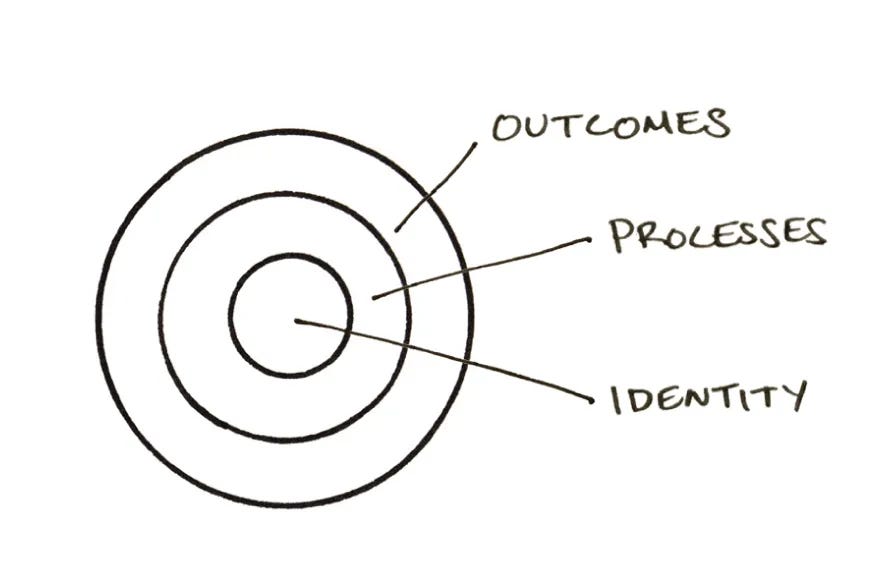

Identity is at the core of change.

Every trader wants to make money in the market, but that’s just the outcome.

One of the most essential habits that sustains that outcome is learning to become an exceptional loser.

It’s easy to chase after the big wins that you think will push your equity curve up. But here’s the truth: even if you land a big win, your losses can quickly wipe it out if you haven’t yet mastered the skill of losing.

So, what’s your attitude toward losing in trading?

In this post, we’ll explore the biology behind losing in trading and how you can start overcoming losses more effortlessly, allowing your winners to reflect on your equity curve.

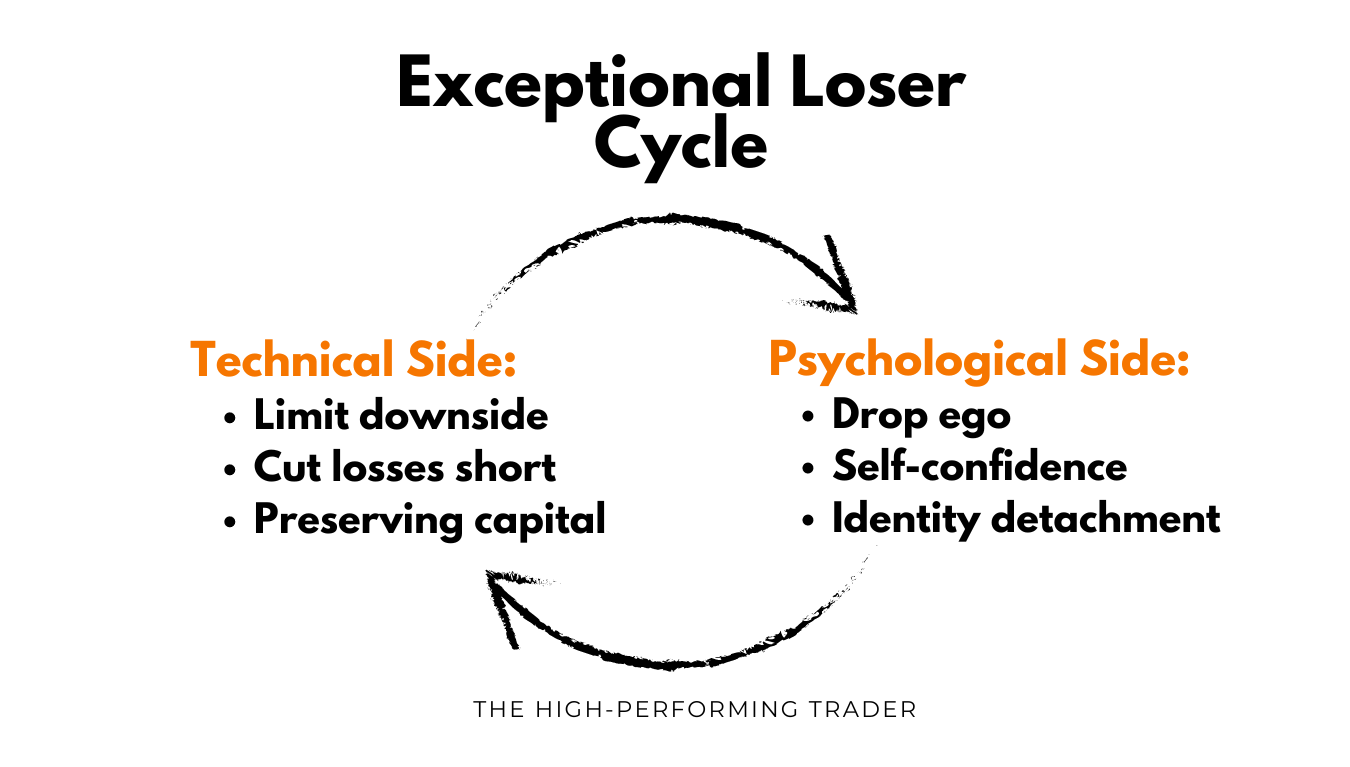

The Two Keys for Exceptional Losing

You’re only ready to become a big winner when you develop the humility to become an even greater loser.

To accomplish this, there are two crucial aspects you need to master:

The Technical Side: Having methods in place to manage risk, limit drawdown, and cut losses short.

The Psychological Side: This is about setting your ego aside and maintaining emotional composure when faced with losses.

These two aspects work together in a cycle:

When you know you’re actively controlling your downside, it lays the foundation for emotional acceptance of losses.

But there are times when this cycle is especially tested, not just psychologically but chemically, too.

Dopamine Dynamics and Trading Losses

We often hear that dopamine gets released when we achieve a reward. But here's the catch: dopamine starts flowing even before the reward, as our brain anticipates it.

This means that certain market scenarios are chemically challenging for your brain to handle, such as:

The Near-Miss: The price gets close to hitting your target, only to reverse and stop you out.

The FOMO Trap: You jump into a trade out of fear of missing out, convinced it’ll be a winner, only to end up with a loss.

The False Breakout: When the market appears to break out of a key level, you feel excited, but then it quickly reverses.

The Sudden Reversal: You enter a trade expecting trend continuation, but the market suddenly reverses.

The Married Trade: Your high hopes on a particular scenario raise dopamine, setting you up for a fall if things don’t go as planned.

In all these typical scenarios, the dopamine released in anticipation of a reward is going to be your worst enemy.

Why?

Your brain expects a win or a certain scenario and floods your body with dopamine, but if the reward doesn’t materialize, dopamine levels crash below baseline.

The “unutilized” dopamine that remains in your bloodstream doesn’t just disappear; it creates a strong drive to continue seeking that reward and recapture that lost high. Yes… we’re talking about revenge trading.

Chemically speaking, these are the moments that are more likely to set you off — both your mind and your brain are against you.

The question is: Can you control your brain’s chemistry?

Well, yes and no.

You can’t stop your brain from releasing dopamine when the price is about to hit a target, serotonin after a win, or adrenaline during high volatility.

However, you can influence your perception of events, which in turn shapes how these chemicals are released.

A study conducted by neuroscientist Wolfram Schultz and published in Behavioral Neuroscience found that our perception of reward probability significantly affects dopamine levels:

When we believe a reward is likely, our brain releases more dopamine in anticipation.

When we acknowledge uncertainty, dopamine levels remain more stable.

Expectations are the basis of the brain’s dopamine reward system.

The solution, however, is not to eliminate them — that would be impossible. Rather, it's to balance them across different market scenarios.

This is easily done before the session starts, but as soon as the market starts playing out one of your "if-scenarios,” you can't help but expect a certain outcome. This is when it’s crucial to switch gears to the “anything can happen” mindset.

Reminding yourself that anything can happen at any point in time while the price is moving (even if it’s only one tick away from your take-profit) helps balance your hormone levels.

This is the way to tilt the mental odds in your favor.

After all, you have more control over your brain’s chemistry than you think.

Losses As a Personal Attack

Proper preparation prevents poor performance.

The best way to take a loss is to anticipate it.

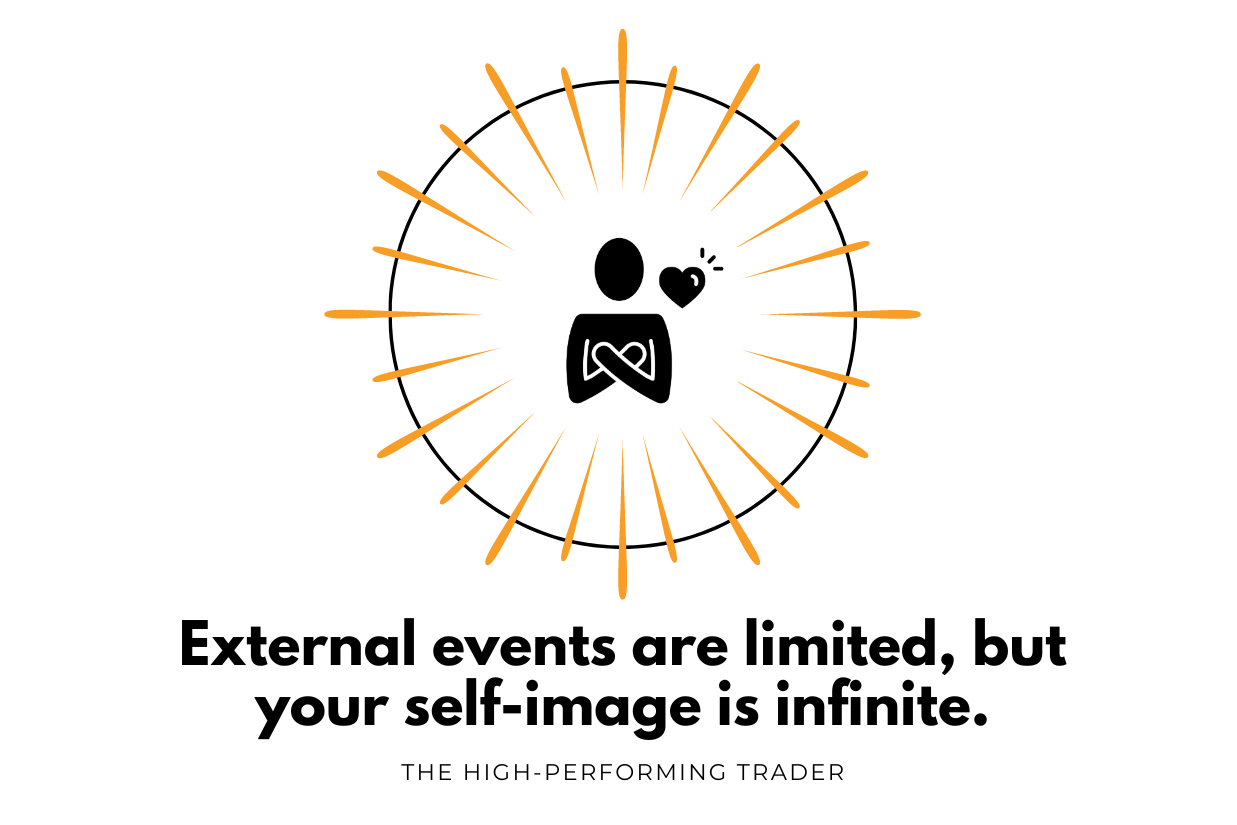

When you see market situations as an attack on your identity, your first instinct is to protect it.

However, the goal of protecting your ego cannot coexist with the goal of optimal performance.

How do you detach your self-image from market events?

A trader who’s confident that a couple of losses don’t reflect their performance is much more likely to accept it and move on.

On the other hand, a trader without this type of confidence quickly falls into the trap of identifying with the loss. When that happens, you’re no longer trading the charts—you’re trading your ego.

Losses can ruin your emotional state only if you doubt the efficiency of your strategy and/or your ability to bounce back.

Fear of loss is almost always connected with low confidence.

Think about a piano player who’s been prepping for months for a big competition but doesn’t win.

If she lacks confidence, she’s going to see that loss as proof that she’s not good enough—the confirmation bias playing in.

However, if she’s confident, there will be a discrepancy between the external event and her internal perception—she knows that one bad performance doesn’t define her skill.

Your level of confidence will dictate the path here:

Either you adjust the reality to reflect your confidence and do better next time.

Or you let your self-image fit your reality and identify as a loser.

Your reality will always fall back on the way you see yourself.

With self-confidence, you’re able to transform losses from threats to challenges.

The brain chemistry associated with these two realities is completely different — instead of heightened cortisol (stress hormone), dopamine and endorphins associated with motivation and resilience take place.

That’s the kind of mindset top traders bring to the table, or better said, to the charts. They know they’ve got an edge, they trust their abilities, and they don’t let a string of losses make them question who they are.

How Deeply Do You Know Yourself?

I saw this post the other day from the amazing actress Viola Davis:

“People can only meet you as deeply they’ve met themselves”… that really resonates.

The same is true in trading: Your results will only reflect your potential as deeply as you’ve taken the time to understand yourself.

Year after year, trading gives you a chance to get to know:

Your traits

Your triggers

Your strengths

Your weak spots

The environments where you thrive

All of this self-knowledge is always within reach; it’s up to you whether you choose to see it.

This is a core focus of my one-on-one coaching with traders. Many have winning strategies, but they struggle to materialize them into consistent profits.

An outside professional perspective unlocks doors they didn’t even know existed, activating new ways to approach the markets—and themselves.

You’re either fully committed to improving yourself to succeed in trading or keep falling short of what you’re truly capable of. The choice is yours.

Task of the Week: Loss Ritual

This week, you’ll create and refine your own Loss Ritual — a set of steps you’ll take after experiencing a loss.

The goal is to turn your perception of a loss from a threat to your identity to a challenge, just like we’ve seen with the piano player example.

There are three steps I consider essential to overcoming loss:

Detaching personally from it

Maintaining a confident mindset

Reframing to the present moment

For your Loss Ritual, outline one activity or a set of them that helps you achieve these three conditions.

To give you a reference point, here’s an example of a Loss Ritual from one of my clients that has been working well for him:

“Refer back to the journal”—He looks at past trades where the same scenario happened, whether it’s a losing streak or atypical market conditions, which boosts his confidence in moving forward.

“Answer the question: ‘What extra piece of information is the market giving me by stopping me out?’”—This helps him identify the current “if-scenarios” and stay grounded in the now.

Let your loss ritual pave the way to becoming an exceptional loser.

With love,

Sara

Here’s a testimonial from Larry, who used to struggle with losses outweighing his wins, leading to negative PnL months. Here’s a glimpse on how we changed that:

Interested in maximizing your trading performance with 1:1 coaching?

Visit my website here.

Audio

Related reads:

Thank you again for this unique newsletter Sara. I have been on vacation for a while and the reason for this vacation was that I was feeling the cortisol build up. The vacation was very good. I am reading your past newsletters again and again. As I mentioned before; you were very useful to me. I am starting to compile the statistics of this process. I will share them with you via e-mail in the coming periods. I am so glad I met you. May your path be clear, may success always be with you.