Thursday Trader's Tip: Detach from Money

Thursday Trader's Tip editions offer quick trading psychology advice that can be digested in 5 minutes.

Watch this edition video at the end of the post.

This read is an adaptation of the excerpt from the paid post “Key Differences Between 5-Figure and 7-Figure Traders.”

If you enjoy the free posts and want an invitation to this Saturday’s webinar, give a try to the paid plan:

You can’t stop caring about money when trading.

However, great traders are able to detach from the dollar sign and view trading as a numbers game at a higher level than beginners do.

During sessions, elite traders’ guiding thought is, “I do what's right and let the market take care of the rest.” They know nothing can go wrong when they worry solely about their part of the game.

This process-focused mindset makes them bolder and free from fear. They're not worried about losing a trade; what they truly worry about is missing a good opportunity—not for the money missed but for failing to act according to their trading principles.

When you act against your core life principles, you create stress. The same is true in trading—frustrating your rules might make you a profit in the short term but pulls your self-confidence down to the bottom.

If you can’t respect the rules you set for yourself, how can you ever find longevity in the business?

Creating trading rules is about internalizing them to the point where they form neural pathways in your brain.

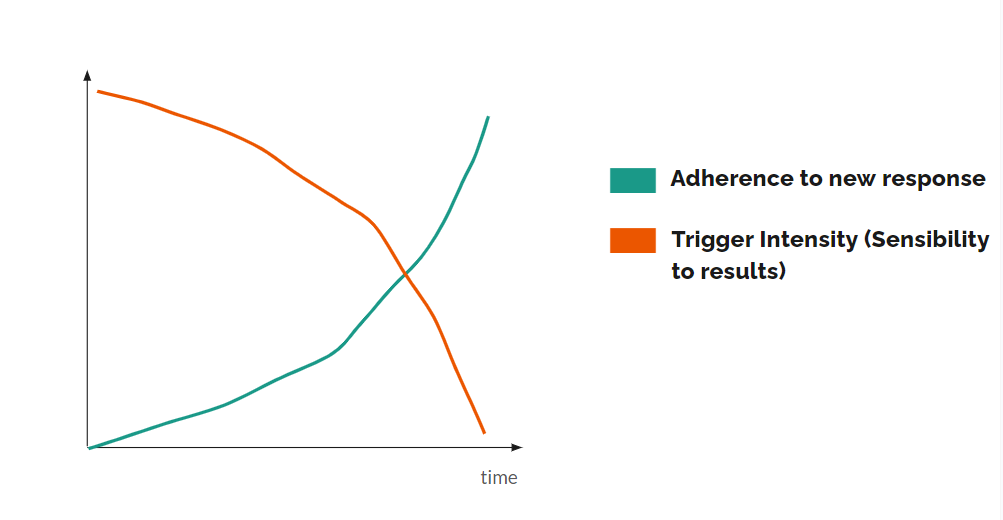

Take a look at the chart below:

The X-axis represents the time to replace the old response with the new one.

A rule’s execution initially depends on your power of will, but with repetition, it becomes part of your being, and little to no effort is required to follow it.

If you can fight through the initial phase, when adhering to the new response is most effortful, you’ll arrive at a place where the old trigger no longer affects you the way it used to. This represents a shift in mindset.

While the neuropathways of least experienced traders are underdeveloped—they’re still fighting through the initial phase of resistance—elite traders have deeply ingrained their rules.

However, to get there, these traders still needed to go through the primary phase, where the limbic friction (as Huberman puts it) was at its highest.

You can’t find peace without going to war first.

While it sounds pretty rough, that’s what it takes to get to resistance-free trading:

Resistance-free from your emotions—you accept them, but they don’t influence you as they used to;

Resistance-free from fighting the market’s uncertainty—you do your part of the job and let the market do the rest;

Resistance-free from trying to get an outcome you can’t control—win or loss, you’re there for the long haul.

Is the initial phase worth the ride? Only you can answer this question. It comes down to how bad you want it.

Peaceful trading,

Sara

If you enjoyed this post, please click the ❤️ button.

If you enjoy the free posts and want an invitation to this Saturday’s webinar, give a try to the paid plan:

Related reads:

Don't miss out on this week's edition in video format:

I m confused whether I m got the chance or .. to join 5th webinar

Sounds like it should be. Trading in the zone is where I learned most so far. Looking forward to some more content