Thursday Trader's Tip: How Great Traders Dance with the Crowd but Never Follow It

Thursday Trader's Tip editions offer quick trading psychology advice that can be digested in 5 minutes.

Watch this edition video at the end of the post.

If you want to have a better performance than the crowd, you must do things differently from the crowd.

— John Templeton

Working with traders across different markets, styles, and strategies, I've noticed a common factor differentiating successful ones: they see mass psychology on the charts.

What does this mean, exactly?

Every successful edge (and by "edge," I mean a combination of strategy and trader) has a way of satisfying these two actions:

Identifying the signs of crowd behavior on the charts.

Using that information to inform your trading decisions.

What Does This Look Like In Practice?

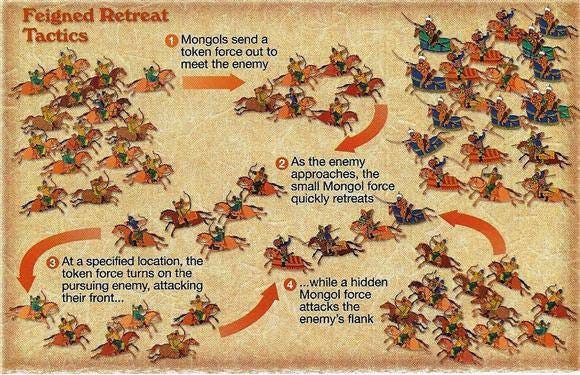

Mass thinking has always been a valuable indicator throughout history. A good example is the Mongol Empire’s use of the feigned retreat (you probably studied this in history classes, but I don’t blame you if you don’t recall).

In battle, the Mongols would pretend to flee, luring enemies into a false sense of victory, and when they’re least expected, they would launch a surprise attack. (the tactic is described in the image above)

The key to this tactic was taking advantage of the enemy’s overconfidence.

Sounds familiar?

This is what happens to many traders.

The market represents the enemy that traps you into high expectations with its moves, and when you least expect, it reverses or does something you were not expecting at all!

It’s under these surprise factor that traders get trapped.

But the reality is: the enemy is yourself. The market makes it hard to detach from expectations at times, but it’s still your responsibility to maintain a neutral view.

What sets the great traders apart from the rest is essentially their power to hold a neutral view of the market regardless of external events.

The rules traders set, like ‘1 trade per day’ or ‘2 losses max and done for the day’, have nothing to do with the market. Mathematically, the more you execute your edge, the more results you’ll see (if there’s an edge!). The point of these rules is to protect yourself of your own perception distortion.

At market open, decisions tend to flow better because your perception is grounded. But as price action unfolds and you see a trade’s results, it becomes more challenging to keep yourself grounded.

In this sense, you must work on two fronts:

Practicing a grounded perspective regardless of external factors (trade results, market moves, etc). This means exposing yourself to enough stress to stretch your discomfort tolerance but not enough to activate the fight-or-flight and spoil performance.

Assessing the quality of your perception during the session and having the humility to recognize when it’s distorted due to emotions or low capacity.

Good trading is a dance between these two.

How Can You See Beyond the Crowd Before Becoming Part Of It?

Once you master your own psychology, you then start to see the mass psychology you were previously trapped in.

It’s not difficult, especially because you’ve been there, but now you’re able to take a big-picture view and see things you wouldn’t before.

This might mean:

Waiting for a level to retest when everyone entered on the breakout.

Taking your profits when everyone is greedy or letting them run when everyone is fearful.

Seeing where the biggest pools of stop losses are likely located and using the information to make your move or practice patience.

However you use it, it’s important to highlight that you’re only able to get better awareness of the market when you know yourself deeply. After all, our emotional brains are very similar.

Better (not more) information gives you an edge.

How are you using crowd behavior to your advantage in trading? Answer in the comments!

Peaceful trading,

Sara

💡If you took value, please tap the ❤️ button share this post to help spread awareness. Thank you for reading!

Ready to commit to the processes for exceptional performance on the charts?

Related reads:

Don't miss out on this week's edition in video format: